Risk assets rose

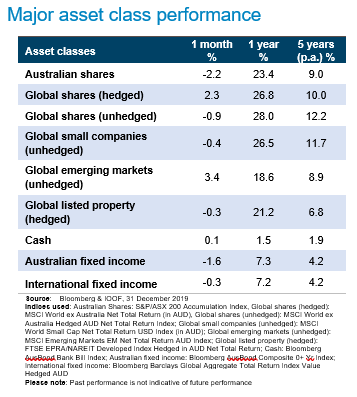

- Global shares were up 2.3% and were down -0.9% in hedged and unhedged terms, respectively. Emerging markets enjoyed strong relative performance (up 3.4%).

- Domestically, Australian shares underperformed international markets falling -2.2% during December. This was driven by rising bond yields as well as stock-specific factors. The former saw rate exposed sectors such as property decline while NAB shares fell -4.9% after ASIC commenced court action over fees from tis financial planning division.

- The Australian dollar (AUD) rose against major currencies by 2.2% on the firming prospects of US-China negotiations as well as stronger commodity prices with iron ore up 8.1% during December.

- Fixed income assets struggled as investors became more optimistic on global growth prospects. The prospect of an initial US-China agreement in January (following tweets from President Trump) contributed to a lift in Australian bond yields with better-than-expected jobs market figures also supporting this move. These factors contributed to a rise in bond yields during December with negative returns for both domestic fixed income and international fixed income.

With inflection in global growth?

Globally

- Global business surveys are pointing to an uptick in growth with the JP Morgan Markit Composite Global PMI at an eight-month high.

- The Conservative Party won the UK elections by 80 seats increasing expectations of a less disruptive Brexit.

- The US and China are expected to reach an initial trade compromise in January.

Locally

- The Reserve Bank of Australia left interest rates unchanged at 0.75%.

- Bushfires continued in regional Australia with the estimated cost continuing to climb. This has implications for agricultural production with both the fires and the drought acting as drags on the economy.

- Rate cut expectations retreated following the stronger than expected labour market data for November. We caution that economic weakness has persisted with weak retail sales and job vacancies growth as well as subdued sentiment. We may see a rate cut sooner than current market expectations (for June 2020).

Locally

- The Reserve Bank of Australia left interest rates unchanged at 0.75%.

- Bushfires continued in regional Australia with the estimated cost continuing to climb. This has implications for agricultural production with both the fires and the drought acting as drags on the economy.

- Rate cut expectations retreated following the stronger than expected labour market data for November. We caution that economic weakness has persisted with weak retail sales and job vacancies growth as well as subdued sentiment. We may see a rate cut sooner than current market expectations (for June 2020).

Recent Comments