A successful retirement means different things to different people.

Whatever your definition of retirement success, one thing is sure – no one wants their golden years pressured by financial concerns.

A bit of careful planning can eliminate the worry of not having enough to live on.

Wherever you are on your road to retirement, it’s never too early to start planning. Even if you feel you’ve left things a little late, planning now can still make a significant difference.

Planning for how long?

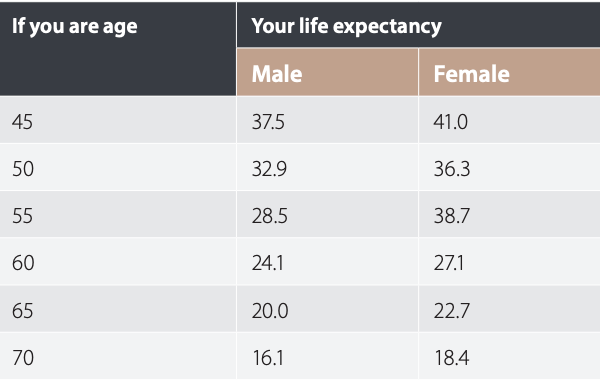

Figures released by the Australian Bureau of Statistics in November 2020 show life expectancy in Australia is the highest on record, and among the highest in the world. A male born in 2017–2019 could expect to live 80.8 years while a female could expect to live 85 years. So, depending on the age you retire, you may need enough to last more than 20 years.

It’s never too late

While people approaching retirement might often wish they had started planning a lot earlier, particularly if volatile market

conditions have reduced the value of many super balances, it is never too late.

Sure, starting early can make a significant difference to your retirement lifestyle, but even well-planned decisions close to retirement are valuable.

Don’t let procrastination or fear of the unknown rob you of a well-planned, successful retirement. It’s never too late to learn either.

Reading, taking courses, researching on the internet, talking with knowledgeable advisers can all add to your ability to make financial decisions that are right for you.

Three core issues need to be considered in retirement planning:

- Your current financial situation – What do you own? How much do you owe? How is your health? How much will you

need to live on? - Your goals – What would you like to achieve – now? in 5 years? in 10 years? in 20 years? Why are these goals important to you? How can you achieve your goals?

- Your timeframe – How far ahead do you need to plan? What sort of time period do you need to plan for?

Lifestyle – getting the balance right

Ensuring you have enough money to do what you want in retirement is an important part of the planning process. While money will not make you happy, it can help you achieve what you want.

But retirement is about more than financial security.

Other aspects will also play an important role in creating a healthy, happy retirement.

Consideration of physical, emotional and psychological aspects will make retirement planning a far more rewarding process.

We recognise six key areas that combine to create a satisfying life.

The ‘life balance wheel’ can help you think about how important the different aspects will be to you when you retire. Evaluating these ‘life balance groups’ will help you clarify what a balanced life means to you.

Family relationships

Retirement will give you more time to invest with family.

Perhaps you want to help raise your grandchildren, spend time with relatives overseas or relax with your partner.

You might find yourself spending more time with loved ones than ever before – and this could perhaps make them in some ways seem ‘less lovable’.

You might need to set out boundaries and personal space. If you and your partner both now find yourselves at home all the time, spending all day every day together may come as a bit of a shock.

This might create some stress in your relationship. Or your child might suddenly expect you to babysit their children all the time since you’ve seemingly got so much time on your hands.

It’s worthwhile thinking about and talking through these issues to ensure your family relationships grow and improve through your retirement experience, and not the reverse.

Health and well-being

Keeping healthy in your mind and body will help you enjoy retirement to the full.

Consider how you will maintain if not improve your health in retirement. Physical activity and a good diet are important, as well as regular medical checkups.

Exercise can be a fun and social experience – from golf and aqua-aerobics to stretching and walking. Remember, good health is all about quality of life.

Learning and intellectual growth

Keeping your mind active is important at all ages. Even if your body is starting to protest against some forms of physical activity, there’s no reason why you can’t remain mentally stimulated.

Whether it’s your local library, a public speaking group, book club or educational course, you’re never too old to learn something new.

Courses at adult education centres, TAFE and community colleges or universities cover diverse interests – from cooking, music and craft to politics and language. Studying in a group environment can provide intellectual stimulation as well as valuable social contact.

Personal development

Retirement years are often a time to reflect on experiences and think more deeply about the world around you and your purpose in life.

Taking the time to review spiritual health can be rewarding. You might just want to think about your feelings and attitudes – and perhaps keep a journal or write your memoirs.

Others might want to get involved in their local church, take up meditation or Tai Chi or spend time in nature. Time out at a health retreat can be regenerating, or you might want to take part in community work or overseas aid projects.

Social connections

Your working life will have given you considerable people contact and you might have created many friendships as a result.

Retirement can potentially leave a large gap.

Some retirees find it very important to maintain the friendships they made while working.

Others are attracted to part-time or volunteer work or join some sort of social group like a sailing club, bush walking group or seniors group. Social interaction promotes physical and psychological health.

Financial security

For years, you’ve probably had a regular pay packet coming in to reward your work.

When you’re no longer working, knowing you don’t have that same earning capacity can be a bit daunting.

Will you be able to afford the retirement lifestyle you desire? A financial adviser can help you work out what sort of retirement income you might need and how to structure investments to help achieve your income.

They will take into account your current circumstances, budget needs and future desires.

Specific goals

Thinking through the life balance issues explored above will help identify specific expenses important to you so you can budget accordingly.

These might include things like an annual interstate trip to visit your grandchildren, membership fees for the local gym, or fuel and motoring fees for your new boat.

The more specific your retirement financial goals, the more realistic and effective your plan can be. The main goal of your financial plan should be to give you the income you need to enjoy the lifestyle you want.

Generally speaking, you can do this by structuring your investments to:

• improve investment returns within your level of risk tolerance

• reduce tax payable

• identify and address tax impacts

• maximise social security entitlements

• provide regular income payments.

How much is enough?

Most people will not have enough money to do all they dream of doing in retirement.

If you were to rely on your investments and savings alone, here’s a rough idea of how much you would need to have saved, depending on the level of retirement income required, and the number of years in retirement.

How much money will you need in retirement?

A modest retirement lifestyle is considered better than the Age Pension, but still only able to afford fairly basic activities.

A comfortable retirement lifestyle enables an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as; household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel.

Both budgets assume that the retirees own their own home outright and are relatively healthy.

Budgets for various households and living standards for those aged around 65 (September quarter 2020, national)

Budgets for various households and living standards for those aged around 85 (September quarter 2020, national)

The figures in each case assume that the retiree(s) own their own home and relate to expenditure by the household.

This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement.

There is more to planning your retirement income than investments and savings alone.

If you have not been able to save enough through the superannuation system, you might be able to supplement your income with a full or part government pension, or convert other assets into appropriate investments.

Conclusion

Take some time to think about yourself and what you enjoy and what will really matter to you in retirement. Write down your thoughts.

Ask yourself:

• What is important to me?

• What are the things in my life that I really enjoy doing?

• What are the things I don’t enjoy doing?

• Are there any areas I would like to improve

• Is there anything I’ve always wanted to do or achieve, but have never had the time?

Think carefully about each of the areas covered in this chapter. Group your ideas under three headings to help form your personal retirement lifestyle plan:

- My current situation

- My goals

- The potential time period I need to plan for

A financial adviser can provide a range of value- added services that could help you plan for a successful retirement, including:

• General investment strategies to help you achieve your goals

• Advice on the structure of superannuation and rollovers

• Tax effective strategies

• Centrelink strategies

• Access to streamlined investment services such as master trusts designed to reduce costs

• Planning income streams to help meet individual needs

• Planning future capital growth strategies

• Access to estate planning and risk protection.

OR CALL US TODAY ON 02 9898 6777

If you want to know more about Nationwide Financial and our Team, click here

Disclaimer: The information provided is general in nature. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider the appropriateness of the information, having regard to your own objectives, financial situation and needs. This publication is prepared by IOOF for: Bridges Financial Services Pty Limited ABN 60 003 474 977 AFSL 240837, Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323, Elders Financial Planning ABN 48 007 997 186 AFSL 224645, Financial Services Partners Pty Ltd ABN 15 089 512 587 AFSL 237 590, Lonsdale Financial Group Ltd ABN 76 006 637 225 AFSL 246934, Millennium3 Financial Services Pty Ltd ABN 61 094 529 987 AFSL 244252, RI Advice Group Pty Ltd ABN 23 001 774 125 AFSL 238429, Shadforth Financial Group Ltd ABN 27 127 508 472 AFSL 318613 (‘Advice Licensees’). This publication is not available for distribution outside Australia and may not be passed on to any third person without the prior written consent of the Advice Licensees. © How to Retire Successfully is copyright and no part may be reproduced without written permission.

Please note this is general advice, so it may not be suitable for you. For personal tailored advice please see a financial adviser. Past performance does not indicate future performance.

Recent Comments